How to use technical indicators for swing trading in cryptocurrency

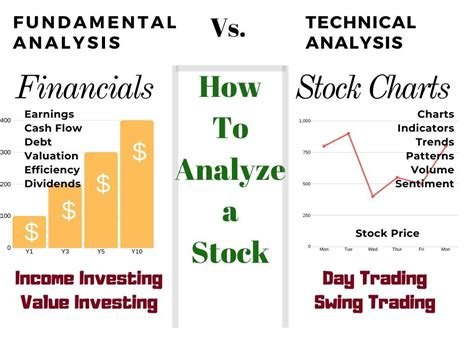

Swing Trading is A Popular Investment Strategy that Involves Using Technical Indicators and Chart Patterns To Make Informed Decisions About Buying and Selling Cryptocurrencies. While Technical Analysis Can Be Used As an Independent Indicator, It’s Essential to Understand How to Combine It With Other Tools, Such as Cryptocurrency-Specific Indicators, to Enhance Your Trading Performance.

What are Technical indicators?

Technical Indicators are Numerical Values that Display The Result of Various Chart Patterns and Trends on a Financial Instrument Like Cryptocurrencies. They help Investors Identify Potential Buy or Sell Signals, Predict Price Movements, and Make Informed Investment Decisions. Common Technical Indicators Used in Cryptocurrency Trading Include:

How to use technical indicators for swing trading in cryptocurrency

To use Technical indicators Effectively for swing trading in cryptocurrency, follow thesis steps:

* Time Frame: 1-Hour or 4-hour Chart

* Candlestick Type: Close, Open, High, Low

* Indicators: Select your preferred indicators for Each Period and Level or Detail.

* Chart Patternerts (E.G., head-and-and-shoulders, inverse head-and-and-shoulders)

* Line breaks or divergence

* Moving Averages Crossing About OR Below

: Determine Your Stop-Loss and Take-Profit Levels Based on Your Risk Management Strategy.

Example: Using RSI AS A Swing Trading Indicator

The Relative Strength Index (RSI) is A Popular Technical Indicator Used to Measure Overbough or Oversold Conditions in Cryptocurrencies Like BTC and ETH. Here’s An Example:

| Time Frame | RSI (14) | RSI (28) |

| — | — | — |

| BTC (1 Hour Chart) | 30 | 70 |

| BTC (4-Hour Chart) | 40 | 60 |

In This Example, The RSI Values Indicate That BTC, overbough at 70 and oversold at 40. This suggests that you should sell or wait for a break $ 6,000 Before Buying.

Additional Tips and Considerations

Conclusion

Technical indicators can be a valuable tool in swing trading for cryptocurrencies like Bitcoin and Ethereum. By Combining them with Other Tools, Such as chart patterns and market sentiment analysis, you can develop a more informed strategy for making profitable trades.

Leave a Reply